Most DeFi yield products chase short-term rates or rely on a single mechanism. We built something different: a dual-source yield structure backed by real-world underwriting activity and collateral assets.

ONyc generates returns the way institutional capital has for decades – through diversified income streams that stay resilient amid market volatility.

The Underwriting Engine

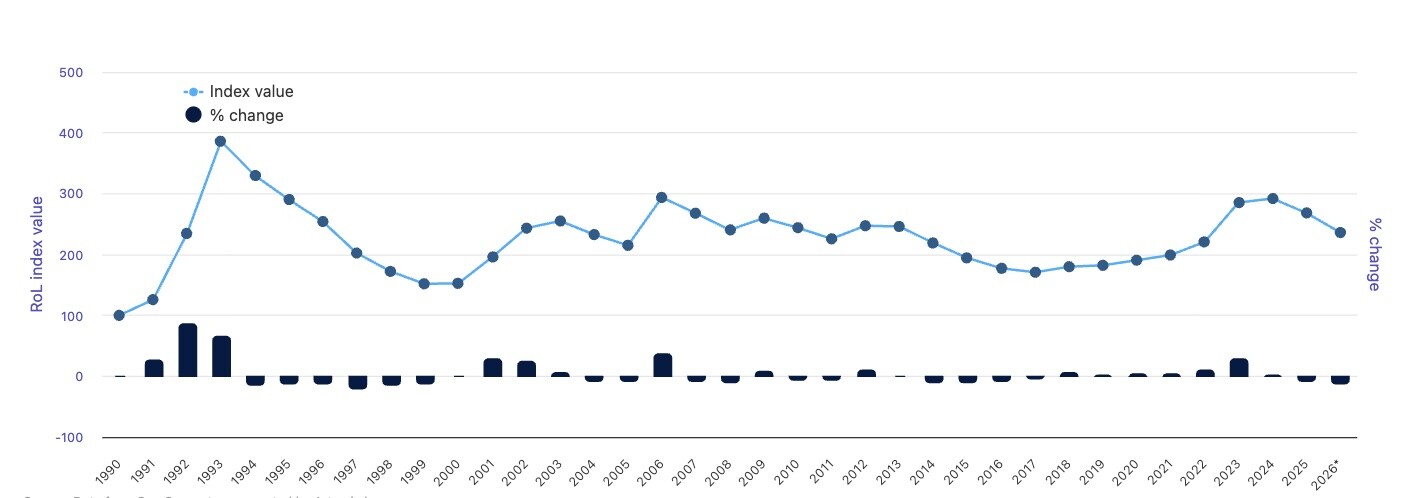

OnRe operates as a licensed reinsurer, taking on specific quantifiable risks from primary insurers in property catastrophe and specialty lines.

Here's how it works: An insurer underwrites a policy but wants to cap their downside on catastrophic events. They pay a premium upfront to transfer that tail risk. We assume that exposure, which is backed by capital from ONyc investors held in a segregated account as reserves to cover potential claims. Each deal is priced using actuarial models and historical loss data.

When realized losses are below premium, investors capture the spread, earning 8-10% annual returns.

Global Property Catastrophe Rate-On-Line Index

The Collateral Layer

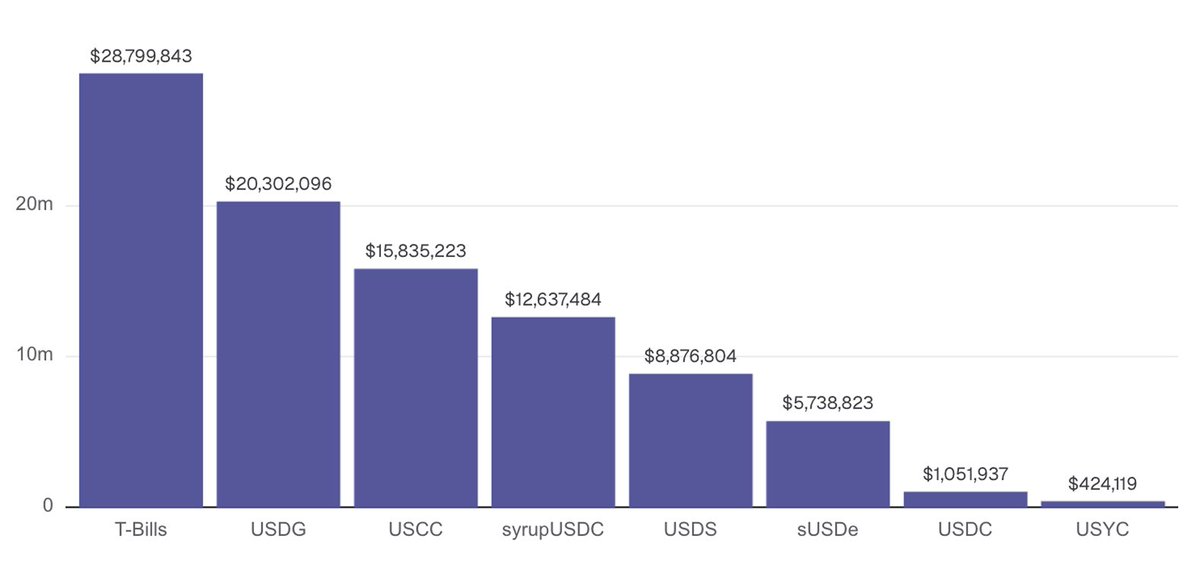

ONyc isn't just insurance capital sitting idle. Our reserves are deployed into yield-bearing stablecoins and tokenized treasuries – actively managed to generate predictable yield for ONyc holders throughout the underwriting period.

When treasury or stablecoin yields rise, collateral compounds investor returns; when yields compress, underwriting provides the stability.

ONyc Collateral

The Result

Reinsurance premiums are uncorrelated with crypto volatility, and capital market yields track broader rate trends. Together, they produce a blended 8-15% annual base yield and a more resilient return profile than either source alone.

ONyc = uncorrelated yield in bear markets, efficient collateral in bull markets.